Make a Claim

Motor Insurance Claim

Simply fill out the claim notification form below and one of our claims specialists will be in contact with you shortly.

Fields marked with an * are required.

About Your Claim

We will contact you as quickly as possible about your claim.

For many claims the insurer will check the circumstances and damage before they authorise and pay for repairs.

The insurer may appoint a loss adjuster or investigator or contact you for more information.

Do Not Authorise Repairs Yourself

If possible, retain any damaged items, as the insurer may need to inspect them before settling your claim.

If possible, please attach proof of purchase, for each item being claimed e.g. receipt, invoice, bank/credit card statement, photo of the items, manual etc.

Important Information

The information requested and documents mentioned in this form are a general guide. Further documents or information may be required depending on the circumstances of your claim.

Please note that failure to provide supporting documentation may result in delays in the processing of your claim.

Your Policy may not provide cover under every section shown in this Claim Form. The issuance and acceptance of this form does NOT constitute an admission of liability by the insurer or waiver of its rights.

If you have any questions about your claim, please contact Clearlake Insurance Brokers on:

If You Are Submitting Via Phone

Before you begin, you will need to download the following images by clicking: Car Damage Image, Other Vehicles Damage Image, and Accident Scene. Once downloaded, you should draw on these images to highlight specific areas of damage or points of interest. After making the necessary annotations, you will need to then attach the edited images to the form in the correct sections.

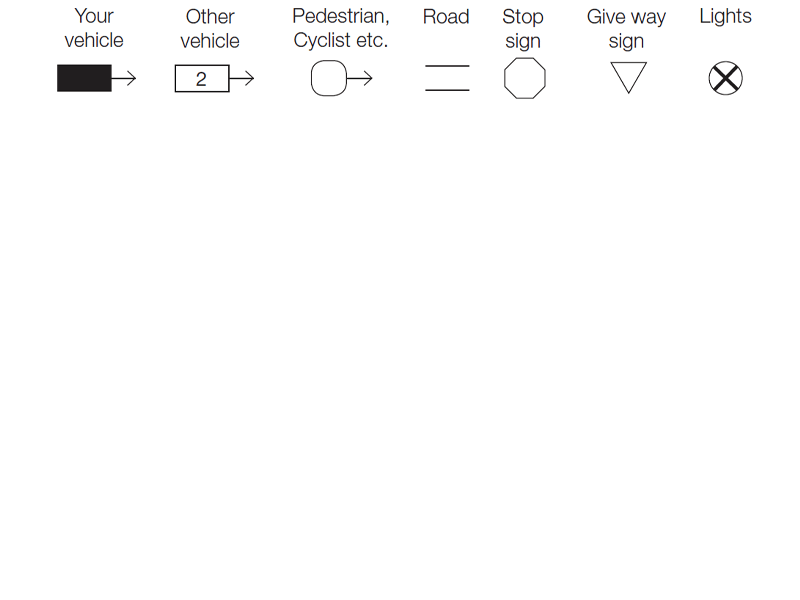

Accident Scene

Using the symbols on this image, draw a diagram of the accident scene showing the position of all vehicles. Indicate by arrows the direction in which the vehicles were travelling, the names of the streets and the north point of the compass. Please identify any other vehicles involved as ’2’, ‘3’, ‘4’ etc. It is important that the sketch be as accurate and as detailed as possible as it may be used in legal proceedings.

Car Damage Image

On this diagram please shade the areas damaged in the accident.

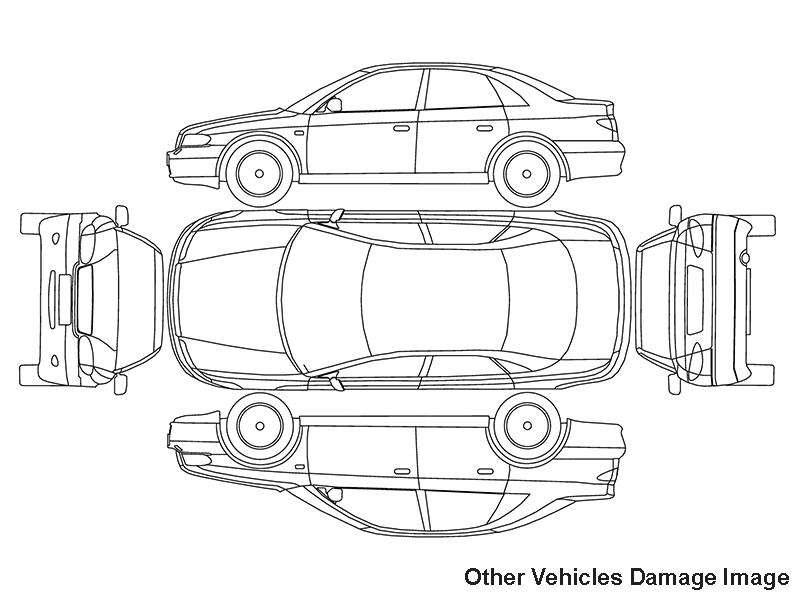

Other Vehicles Damage Image

On this diagram please shade the damaged areas of the other

vehicle(s) damaged in the accident.

Motor FAQs

What information do I need to get started on my motor claim?

When completing your motor claim notification form online, you'll generally need to provide the following information:

- Your policy number

- A description of the incident, including when and where it occurred

- Information about the damage, including its type and extent

- Details of any other parties involved, such as their name, address, and license or registration number

- Any relevant documentation or photos, if available

We’re here to help make this process as smooth as possible, so please reach out if you have any questions or need assistance.

What should I do if I have an accident?

Clearlake Insurance Brokers are seeking a insurance broker to join our team.

If you find yourself in an accident:

- Contact emergency services if necessary for immediate assistance.

- Gather the contact details of the other drivers involved, including their name, address, phone number, email address, license number, and insurance information, as well as the vehicle registration number and the make and model of their vehicles.

- If there are any witnesses, make sure to collect their contact details as well.

- When it’s safe, take photos of any damage to the vehicles involved.

We’re here to support you through every step of the process, so please don’t hesitate to reach out if you need any help.

What documents do I need to make a claim?

If you are notifying us of a motor claim, some examples of the types of documents you may include are:

- Valuation certificates

- Photos of the incident

- Receipts

- User manuals

Can I use my own repairer?

Depending on your policy, you might have the option to choose your own repairer. When completing your claim notification form, you’ll be able to select whether you’d like to nominate your own repairer or use one recommended by the insurer if your vehicle has been damaged.

If you’re unsure about your options, your claims specialist or broker can help clarify whether you can choose your own repairer.

While you can select your own repairer, we often recommend using one of the insurer’s preferred repairers. This choice can potentially shorten the repair time by up to 5 days and ensure that the repairs are guaranteed by the insurer. We’re here to assist you and make the process as smooth as possible.